A Guide to Competitor Analysis Frameworks

A competitor analysis framework is really just a structured way to make sense of everything you learn about your rivals. Instead of drowning in a random collection of facts and figures, it gives you a repeatable blueprint to map out their strengths, pinpoint their weaknesses, and spot opportunities you might have otherwise missed.

Think of it this way: you could either watch what other players are doing on the field, or you could show up with a strategic game plan. A framework is your game plan.

Why a Structured Framework Is Your Strategic Blueprint

Let’s be honest, without some kind of structure, competitor analysis gets messy—fast. You end up with a digital pile of pricing sheets, random social media posts, and a handful of product reviews, but no real way to connect the dots. A formal competitor analysis framework is what turns all that chaos into clarity.

It’s the difference between building a house with an architectural blueprint versus just stacking bricks and hoping it doesn’t fall over.

This structured approach helps you shift from being reactive—always scrambling to counter a competitor’s latest move—to being proactive. It lets you anticipate where the market is headed, find underserved customer segments, and make decisions based on solid evidence, not just a gut feeling. The real goal here is to build a lasting advantage by simply understanding the competitive playing field better than anyone else.

The Evolution from Reaction to Proactive Strategy

For a long time, many businesses just played defense, constantly reacting to what their rivals did. This meant they were always one step behind. The move toward structured analysis completely changed that dynamic.

Back in 1999, management scholar Liam Fahey introduced a framework that looked at competitors on three interconnected levels: the entire competitive system, a single competitor, and the broader market environment. This multi-layered view was a huge step toward the kind of proactive planning we see today. You can learn more about this structured approach and how it has shaped modern strategy.

This way of thinking gives businesses a repeatable method to:

- Spot Hidden Opportunities: Find the gaps in the market that your competitors have completely overlooked.

- Anticipate Threats: See potential challenges coming—whether from a new startup or a shift in market trends—before they become full-blown problems.

- Refine Your Value Proposition: Get crystal clear on what makes your product or service stand out and learn how to communicate that difference effectively.

- Make Smarter Investments: Put your time, money, and resources where you have the best shot at winning.

At the end of the day, a competitor analysis framework isn’t about generating a one-off report to gather dust. It’s about building a continuous intelligence process that feeds into every major decision you make—from product development and marketing to sales and long-term planning. It’s the foundation for building a truly resilient and adaptable business.

Choosing the Right Framework for Your Business

Think of competitor analysis frameworks like different lenses for a camera. Each one brings a specific part of the competitive landscape into focus. A wide-angle lens captures the big picture, while a macro lens zeroes in on the tiny details. The framework you choose determines what you see.

There’s no one-size-fits-all model here. The best framework depends entirely on the questions you need answered. Are you trying to size up your own company’s health against the market? Or are you more interested in the overall structure and profitability of your industry? Your goal picks the tool.

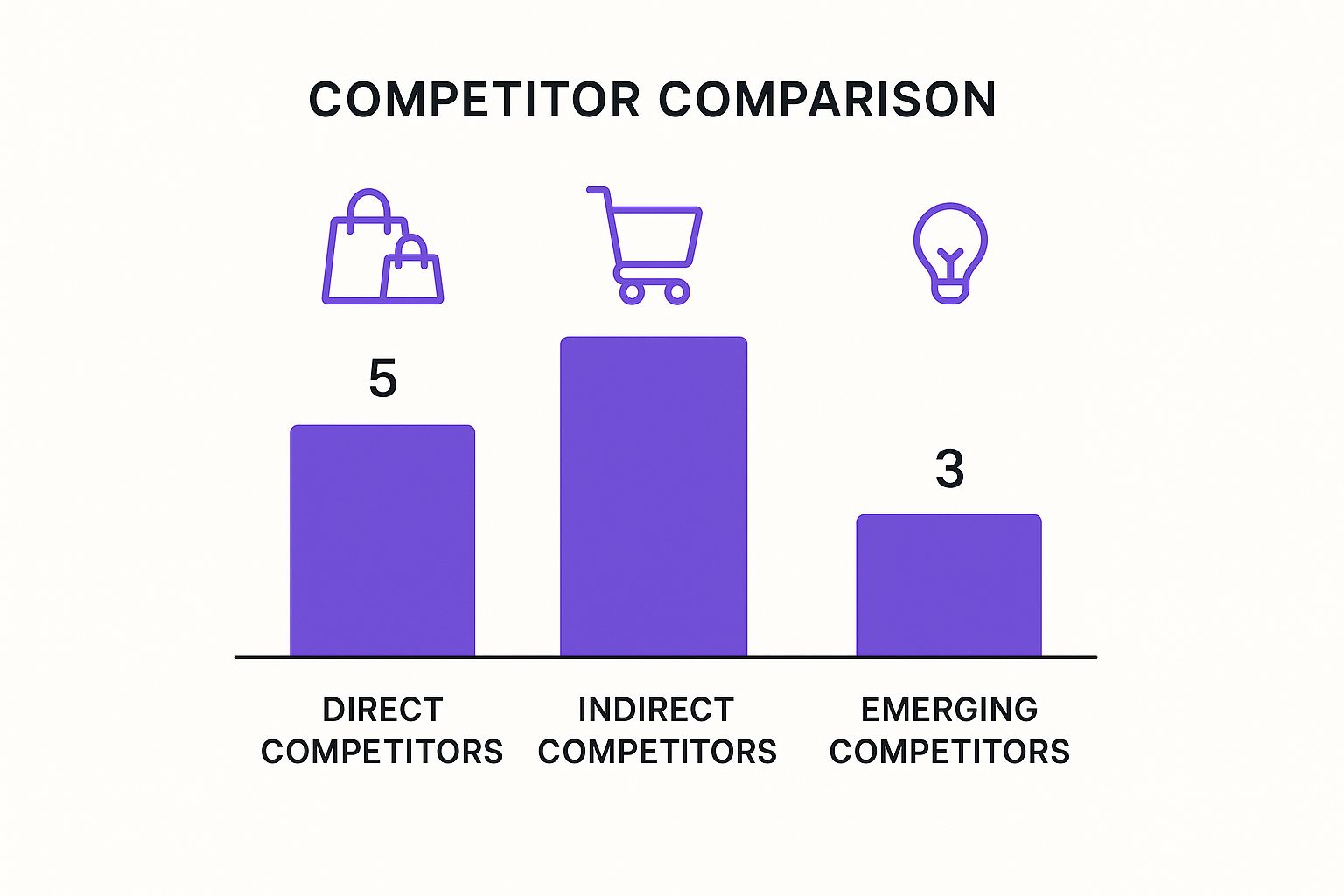

This image breaks down the typical players you'll be up against, showing a mix of direct, indirect, and emerging threats.

It’s a great reminder that your indirect competitors often outnumber the direct ones, so it pays to look beyond the obvious rivals for a complete view of the market.

To help you get started, here’s a quick comparison of the most popular frameworks and when to use them.

How to Select Your Competitor Analysis Framework

| Framework | Primary Focus | Best Used For | Key Question Answered |

|---|---|---|---|

| SWOT Analysis | Internal strengths and weaknesses vs. external opportunities and threats | Quick, high-level strategic planning and initial business assessments | "Where do we stand right now, both internally and in the market?" |

| Porter’s Five Forces | Industry structure and profitability | Evaluating long-term market attractiveness and competitive intensity | "How profitable is this industry, and what forces shape that profitability?" |

| PEST Analysis | Macro-environmental factors (Political, Economic, Social, Technological) | Long-range forecasting and understanding external market shifts | "What major external trends could impact our business?" |

This table should give you a solid starting point for picking the right lens for your analysis. Let's dive a little deeper into each one.

Start With an Internal and External View Using SWOT

A SWOT analysis is almost always the perfect place to start. It forces you to look both inward at your own company and outward at the market, giving you a balanced perspective right from the get-go. It’s a foundational framework that maps out your Strengths, Weaknesses, Opportunities, and Threats.

- Strengths: What do you do better than anyone else? This could be a unique product, a killer brand reputation, or top-notch customer service.

- Weaknesses: Where do your competitors have an edge? Be brutally honest about product gaps, limited resources, or a weaker market presence.

- Opportunities: What market trends or gaps can you jump on? Think about underserved customer segments or new tech you can adopt.

- Threats: What’s on the horizon that could hurt your business? This includes new competitors, changing regulations, or shifts in what customers want.

SWOT is incredibly versatile. It’s perfect for startups needing a quick gut check and for established companies planning their next big move. The key is to be honest—an unbiased evaluation is the only way to get a clear picture.

Decode Industry Profitability With Porter's Five Forces

If your main goal is to understand the deep structure and long-term profitability of your industry, Porter’s Five Forces is your tool. It goes way beyond just looking at your direct rivals and instead analyzes the power dynamics that shape the entire market.

This model digs into five key pressures:

- Competitive Rivalry: How intense is the fight among existing players?

- Threat of New Entrants: How easy is it for new companies to jump into your market?

- Bargaining Power of Buyers: How much power do customers have to push your prices down?

- Bargaining Power of Suppliers: How much control do your suppliers have over your costs?

- Threat of Substitute Products: How likely are customers to find a totally different way to solve their problem?

By looking at these forces, you can figure out what really makes an industry tick and where the biggest strategic challenges are hiding. It helps answer the big question: "Is this market getting more or less profitable over time?"

Map Macro-Level Trends With PEST Analysis

Sometimes the biggest game-changers come from way outside your immediate industry. A PEST analysis helps you zoom out and see that bigger picture by examining four macro-environmental factors: Political, Economic, Social, and Technological.

This framework is crucial for getting a handle on external forces that are completely out of your control but could seriously impact your business. A new data privacy law (Political) or a looming recession (Economic) could reshape your entire strategy overnight. Using PEST helps you anticipate these shifts instead of just reacting to them.

A competitor analysis framework gives you a structured way to gather intelligence and make smarter strategic bets. Classic models like SWOT are used everywhere to assess a rival's position, while PEST analysis broadens the view to catch external factors. Porter's Five Forces drills down even deeper, analyzing the core competitive pressures in an industry to get a real sense of its profitability.

Ultimately, the best competitor analysis framework is the one that clarifies your thinking and gives your strategy direction. By using these tools, you can sharpen your market position and make decisions with more confidence. Understanding how you stack up is the first step in defining what makes you unique—the core of building a strong brand. For more on that, check out our complete guide to creating a brand positioning framework.

Choosing the right lens helps you see the path forward clearly.

How to Conduct Your Competitor Analysis

Alright, let’s move from theory to action. A solid competitor analysis framework isn't just about hoarding data—it’s about turning that information into a real strategic advantage. The best way to do this is with a clear, repeatable process.

Think of it as a four-stage mission. Each step builds on the last, keeping you focused and preventing that dreaded "analysis paralysis" where you're drowning in data but have no idea what to do with it.

This whole process kicks off with one simple question: "What are we actually trying to accomplish here?"

Stage 1: Define Your Goals and Identify Competitors

Before you even think about spying on your rivals, you need to know why you're doing it. What’s the end game? Are you trying to see how your product features stack up? Figure out a competitor's pricing strategy? Or maybe explore a new market they’re tapping into? Clear goals are your compass.

For instance, a vague goal like "learn about the competition" won't get you far. A sharp goal will. Something like: "Identify gaps in Competitor A's content strategy so we can boost our organic traffic by 15% this quarter." See the difference? Now you know exactly what to look for.

With your goal set, it's time to line up the competition. Don't just look at the obvious players. You need to map out the entire field:

- Direct Competitors: These are the companies selling a similar product to the same customers. Think another project management tool.

- Indirect Competitors: They solve the same problem but with a different solution. For example, a simple spreadsheet template versus your project management software.

- Emerging Competitors: Keep an eye on the new kids on the block. These are the startups or pivoting companies that could be a major threat tomorrow.

Stage 2: Gather the Right Data

Now that you know your mission and your targets, it's time for some intelligence gathering. The trick is to use a mix of public sources and specialized tools to build a full picture of each rival. To really nail this part, you'll need a solid methodology, which is covered well in this guide on conducting competitive analysis that wins.

Start with their digital footprint. Dig into their website, social media, and blog to understand their messaging. What story are they telling? Who are they talking to? Seeing how they engage their audience can teach you a lot about how to create buyer personas for your own strategy.

Your goal isn't to collect every scrap of information out there. It's to find the right data that directly answers the questions you set in Stage 1. Focus on quality over quantity. That’s what keeps your analysis sharp and actionable.

Stage 3: Apply Your Framework and Analyze

This is where you bring structure to all that raw data you've collected. Pull out the competitor analysis framework you chose—whether it's a SWOT analysis, Porter's Five Forces, or a basic feature comparison grid.

The framework is like a lens. It helps you filter the noise and start spotting the important patterns, trends, and connections. A SWOT analysis, for example, will let you pit your strengths against their weaknesses, revealing clear opportunities to stand out.

This is the stage where information becomes insight. Look for themes in their customer reviews, find the inconsistencies in their marketing, or notice which features they shout about versus the ones they barely mention.

Stage 4: Turn Insights Into Action

Here we are—the most important step. A brilliant analysis is completely worthless if it just sits in a folder and doesn't lead to a decision.

For every key insight you uncover, you need to define a specific, measurable action. Did you find out your top competitor has terrible customer support? Great. Your action might be to launch a marketing campaign that screams about your 24/7 live chat support. Is their pricing page a confusing mess? Your move could be to simplify your own pricing and hammer home your transparency.

This is what closes the loop. It turns your competitor analysis from a one-off project into a powerful engine for continuous improvement and smart growth.

Using Scorecards to Quantify Your Findings

After sifting through mountains of data on your competitors, you hit a common wall: how do you make sense of it all? More importantly, how do you turn subjective observations into something concrete that stakeholders can understand at a glance?

This is where a competitor scorecard comes in. It’s a simple but incredibly effective tool that translates fuzzy data points—like brand perception or product quality—into a straightforward numerical comparison. Your analysis instantly shifts from opinion to objective, data-backed insight.

Instead of just saying a competitor has "strong" marketing, a scorecard forces you to define what "strong" actually means and rate it on a consistent scale. This methodical approach ensures every competitor is judged by the same rules, making your final comparison fair and much easier to defend.

Designing Your Weighted Scoring System

The real power of a scorecard isn't just in the scoring itself, but in the weighting. Let’s be real—not every factor carries the same strategic weight. A weighted scoring system lets you assign more importance to the criteria that actually move the needle for your business.

For example, if you’re a scrappy startup trying to out-innovate the competition, Product Features might be worth 30% of the total score. But for an established brand, Brand Reputation might be the top priority, earning a 25% weight. This is how you align the analysis directly with your own business goals.

Ready to build your own? It's pretty straightforward:

- List Your Criteria: Start by identifying the key battlegrounds in your market. This could be anything from pricing and marketing reach to customer support and user experience.

- Assign Weights: Distribute 100% across your criteria based on what truly matters. What are the non-negotiables for winning in your space?

- Define a Scoring Scale: Keep it simple and consistent. A 1-to-5 scale works great, where 1 is weak and 5 is strong.

- Score and Calculate: Now, grade each competitor on every criterion. Multiply that score by the weight you assigned to get the final weighted score for that category.

This process strips out the guesswork and bias, boiling a complex analysis down to a clear, at-a-glance comparison. You’ll immediately see who’s leading the pack and where your biggest opportunities are hiding.

Transforming Data into Clear Comparisons

With a completed scorecard in hand, the insights practically jump off the page. You can pinpoint exactly which competitors are crushing it in specific areas and where they’re falling behind. This quantitative view gives you the confidence to present your findings and make sharp, decisive recommendations.

Quantifying competitor data this way isn't just a "nice-to-have" anymore; it's a core part of modern strategy. In fact, companies that adopt this kind of scoring have reported up to a 30% improvement in the accuracy of their strategic forecasts and a 25% reduction in time spent on manual research.

A well-structured scorecard doesn't just show you who is winning; it tells you why they are winning. It points directly to the specific strategic areas—be it their social media engagement or their pricing model—that are giving them an edge.

This kind of granular insight is invaluable. For example, if a scorecard reveals a competitor's weak social media game, that's a clear signal for you to double down and own that channel. To do it right, you'll need to understand the quirks of each platform, which is why we created a comprehensive guide explaining social media algorithms.

Here is what a simple scorecard could look like:

Example of a Weighted Competitor Scorecard

| Criteria | Weight (%) | Competitor A Score (1-5) | Competitor A Weighted Score | Competitor B Score (1-5) | Competitor B Weighted Score |

|---|---|---|---|---|---|

| Product Features | 30% | 4 | 1.2 | 3 | 0.9 |

| Pricing | 25% | 3 | 0.75 | 5 | 1.25 |

| Brand Reputation | 20% | 5 | 1.0 | 3 | 0.6 |

| Marketing Reach | 15% | 3 | 0.45 | 4 | 0.6 |

| Customer Support | 10% | 4 | 0.4 | 2 | 0.2 |

| Total | 100% | N/A | 3.8 | N/A | 3.55 |

In this example, even though Competitor B has superior pricing, Competitor A comes out ahead overall due to stronger product features and brand reputation. By turning abstract concepts into hard numbers, a scorecard gives you the clarity needed to make smarter, evidence-based decisions that create a real competitive advantage.

Common Mistakes in Competitor Analysis

You can have the most sophisticated competitor analysis framework in the world, but it won't save you from a few classic, all-too-human mistakes. It’s easy to fall into these traps, and when you do, your strategy gets derailed, resources get wasted, and big opportunities are missed.

The biggest mistake? Tunnel vision. This is where you get so fixated on your main, well-known rival that you completely ignore the real threats lurking just out of sight.

You spend all your energy tracking every little move your biggest competitor makes, while a scrappy startup is quietly rewriting the rules of the game and stealing your future customers. That kind of narrow focus creates massive blind spots, leaving you wide open to disruption.

Sticking to a "One and Done" Mindset

Treating competitor analysis like a one-off project you can check off a list is a guaranteed way to fall behind. The market isn’t a static photograph; it’s a living, breathing thing that changes by the minute. A report that felt insightful six months ago is probably dangerously out of date today.

Your competitors are constantly tweaking their products, refining their marketing, and shifting their prices. If your analysis isn't keeping up, you're making decisions based on old news.

The goal isn't to create a single, perfect report. It's to build a continuous intelligence system that feeds your strategy in real time. This ongoing process is what separates the market leaders from everyone else playing catch-up.

This means weaving competitive intelligence into your regular strategic planning. It needs to be a constant pulse you monitor, not a yearly checkup. That's how you ensure your moves are always based on what's happening right now.

Falling into Analysis Paralysis

Then there's the other extreme: "analysis paralysis." This is what happens when you drown in data. You collect so much information that you can't see the forest for the trees, leaving you with piles of spreadsheets but zero actionable insights.

The only way to avoid this is to start with a clear goal. What specific questions are you trying to answer? A focused analysis that delivers a few powerful insights is infinitely more valuable than a sprawling report that tells you everything and nothing at the same time.

Here are three common ways analysis paralysis takes hold:

- Ignoring Indirect Competitors: You're not just losing customers to direct rivals. Sometimes, they choose a completely different type of solution to solve their problem. If you aren't looking at those alternatives, you only have half the picture.

- Surface-Level Data Collection: It’s not enough to just know a competitor’s price. You need to dig deeper and understand the why behind it. What’s their positioning? Their value proposition? How do customers see them? Without that context, the data is useless.

- Lacking an Action Plan: Your analysis has to end with a clear "so what?" and "now what?" If it doesn't lead to concrete next steps, it’s just an academic exercise. Insights without implementation are worthless.

Ultimately, getting this right does more than just inform your strategy. When you consistently show you have a deep, nuanced understanding of the market, you learn how to build credibility with your team and your customers, turning what could be a simple report into a real competitive edge.

Turning Your Analysis Into a Strategic Advantage

Let's be honest: the point of all this isn't to create a beautiful report that ends up collecting dust on a server somewhere. The real goal is to spark decisive action—the kind that builds a lasting competitive edge. Data is just the starting point. It’s what you do with that data that separates the market leaders from everyone else.

This whole process kicks off by picking the right framework for the questions you need answered. A SWOT analysis is great for a high-level gut check, while a scorecard gets you into the nitty-gritty details. The tool has to fit the task. From there, it’s all about creating a system and avoiding common pitfalls, like getting stuck in "analysis paralysis" or only keeping an eye on your most obvious rivals.

Weaving Analysis into Your Business DNA

The companies that consistently win are the ones that treat competitor analysis as an ongoing conversation, not a one-off project. It becomes a living, breathing part of their strategic planning cycle.

Think of it as a constant feedback loop where insights from the market directly inform every major decision, from product roadmaps to marketing campaigns. This keeps your strategy sharp, relevant, and ready to move with the market. When this becomes a habit, you start to develop a much deeper, more intuitive feel for the competitive landscape. It’s a proactive stance that lets you spot shifts on the horizon, neutralize threats before they grow, and find those little windows of opportunity that your competitors completely miss.

The true power of a competitor analysis framework is only unlocked when its insights are translated into consistent action. This disciplined approach builds momentum, strengthens your market position, and fosters a culture of smart, informed decision-making.

Ultimately, you're building a well-oiled intelligence engine that fuels your growth and innovation. Consistently applying these insights doesn't just sharpen your strategy; it also makes your message to the market crystal clear. This is a huge piece of building a strong presence, which ties directly into understanding what is brand consistency and how it shapes the way customers see you. Get this right, and you'll be set up to consistently outperform the competition.

Got Questions? We've Got Answers

Diving into competitor analysis can feel like you're trying to solve a puzzle. It's totally normal for questions to pop up, especially when you're figuring out where to put your time and effort. Here are some of the most common ones we hear, along with some straight-up, practical advice.

What's the Best Framework for a Startup?

If you're a startup, your best bet is to pair a simple SWOT analysis with a direct Competitor Profile. This combo is a powerhouse because it's quick, efficient, and gives you actionable insights right away without needing a huge team or budget.

SWOT is perfect for getting a quick snapshot of your internal strengths and weaknesses versus what's happening in the market (opportunities and threats). Then, the Competitor Profile lets you get laser-focused on just a few key rivals to really understand their products, pricing, and how they talk to customers. It’s all about getting a solid foundation to make smart moves early on.

This two-pronged approach helps you skip the overwhelm of bigger, more complex models like Porter's Five Forces. Those become way more useful once you're a bit more established. For now, speed and clarity are your best friends.

How Often Should I Run a Competitor Analysis?

Think of competitor analysis as a living process, not a one-and-done task. The market is always changing, and what you learned six months ago could be ancient history today. As a rule of thumb, a full, deep-dive analysis should happen quarterly or at least twice a year.

But some things move faster than others. You’ll want to keep a much closer, almost constant eye on the more dynamic elements, like:

- Pricing Changes: Are your competitors running a sale or quietly hiking up their prices? This is especially critical in fast-paced markets.

- Marketing Campaigns: Watch for new ads, messaging, or campaigns they're launching. It tells you where their head is at.

- Social Media Activity: Keep tabs on what they're posting, how people are reacting, and what customers are saying.

This kind of ongoing intel means you can adjust your strategy on the fly, instead of reacting to information that’s already stale.

What Are Some Good Tools for Gathering Data?

Let's be real—collecting all this data manually is a drag. The key to an efficient analysis is streamlining the process, and luckily, there are some fantastic tools out there that can do the heavy lifting for you.

For digging into SEO and content, you can't go wrong with industry workhorses like Semrush and Ahrefs. They're brilliant for tracking keywords, backlinks, and web traffic. To get a handle on social media intelligence, platforms like Sprout Social are great for monitoring what people are saying about your competitors. And for product and feature comparisons, don't sleep on review sites like G2 or Capterra—they're a goldmine of genuine customer feedback.

Finally, never underestimate the power of a simple, free tool: Google Alerts. Set it up for your competitors' names, and you’ll get a neat little notification anytime they’re mentioned online. Easy and effective.